The Education Property Tax Rebate

October 18th, 2022 by Simon Reimer

A new program to help eliminate the Education Property Tax in Manitoba

The Province of Manitoba is continuing its phase out of the Education Property Tax in Manitoba, moving from a locally-determined model for funding education to funding out of general revenues. The Government states this will put Manitoba on equal footing with other provinces. Currently, Manitoba is the only province which operates under a locally-determined tax.

Prior to the new rebate program, the Province of Manitoba reduced the tax burden exclusively through the Education Property Tax Credit. This system was a way for both property owners and renters to receive a credit on their taxes for the money paid towards education property taxes. The Education Property Tax Credit has been around since before 1999, when it was worth up to $250 per property. It increased until it maxed out at $700 in 2011. The credit remained under this form until 2021, when the new rebate system came into effect, but more on that later. Renters were also covered; every year, a renter could claim the Education Property Tax Credit under the notion that the costs of the education property tax would be passed along to renters by landlords. In 2021, the amount of this credit was $525.

The Education Property Tax Credit Advance is applied directly to municipal property tax statements for homeowners. For renters, the tax credit could be claimed on their yearly income tax returns.

In April of 2021, the Province of Manitoba announced the Education Property Tax Rebate. This program is part of a multi-year phased elimination of education property taxes and part of a broader plan to reduce taxes for Manitobans.

The Education Property Tax Rebate involves directly reimbursing people for education property taxes. The Province issues a cheque to property owners offsetting a portion of the education taxes paid for the year.

How does it work?

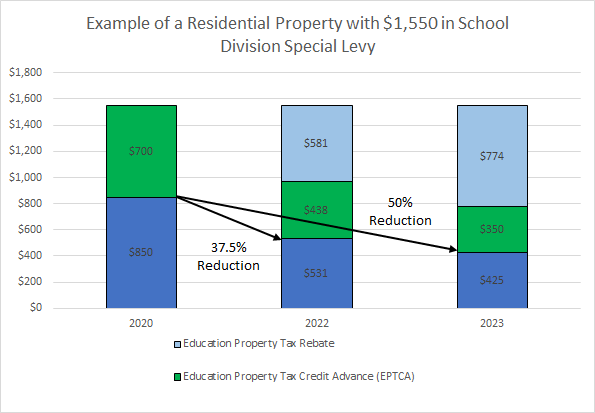

The Province wants to reduce the total ‘School Division Special Levy’ (education property tax) by 37.5% in 2022, and then by 50% in 2023. That means that if your net education property taxes paid in 2020 were $850, in 2022 you would pay a net tax of $531, and in 2023, your net tax would be $425.

They accomplish this through a combination of the Education Property Tax Credit Advance (EPTCA) and the new Education Property Tax Rebate (EPTR). The EPTCA will slightly decrease each year, while the size of the cheque you receive under the EPTR will increase each year until the education property tax is eliminated completely. The figure below is an illustration of how this is expected to work in 2022 and 2023.

The example above is based on a fictional education property tax of $1,550. In 2020, this homeowner would have seen $1,550 on their tax bill. The EPTCA provided a $700 credit and directly applied it to their taxes, resulting in a total education property tax of $850.

For the 2022 tax year in this example, a rebate is issued under the new EPTR. The homeowner in this example would receive a cheque for $581, as well as see a credit on their tax bill for $438. This reduces the education property tax by $1,019. The reduction in tax paid between 2020 and 2022 (from $850 down to $531) equals 37.5% – more than $300 in total reduction.

For the 2023 tax year, the homeowner would again receive a rebate cheque, this time for $774. The homeowner also receives a credit on their bill for $350. The total reduction on the original $1,550 bill for 2023 equals $1,124. The total tax paid goes from $850 in 2020 to $425 in 2023, a reduction of 50%.

Through all of this, the education property tax continues to appear on the homeowner’s property tax bill as $1,550, but the combination of rebates and credits will steadily reduce the net tax paid until it equals $0. There have been no announcements by the Government on when they expect to officially end both the rebate and the education property tax.

The consequence of the rebate system for property owners is simple: each year, the property owner will get an increasingly large rebate cheque as well as an increasingly small credit applied directly to the tax bill. Eventually, the tax will be phased out altogether along with the rebates and the credits. Rebate cheques are expected to be sent to the registered property owner in the same month that property taxes are due with their respective municipalities. For property owners in Winnipeg, look for your cheque to arrive in June, whereas for most RMs, look for your cheque to arrive in September or October.

Notice: The articles on our website are provided for general information purposes only and should not be relied upon as legal advice or opinion. They reflect the current state of the law as at the date of posting on the website, and are subject to change without notice. If you require legal advice or opinion, we would be pleased to provide you with our assistance on any of the issues raised in these articles.