Changes to Educational Property Tax: The Education Property Tax Rebate

May 14th, 2021 by Gemma Brown

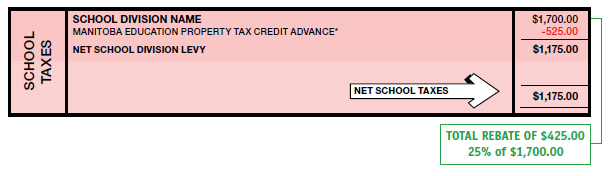

In this year’s Provincial Budget 2021, the Manitoba government began its strategy to eliminate educational property taxes for Manitobans. Specifically, the government implemented two main changes: a reduction in the Education Property Tax Credit and Advance (from a maximum of $700 to a maximum of $525 annually), and the implementation of the Education Property Tax Rebate (EPTR).

Despite the implementation of the EPTR, property owners will continue to pay education property taxes until they are completely phased out. Until then, they will receive the EPTR annually beginning in 2021, in the form of a cheque issued by the Manitoba government. Owners of residential and farm properties will receive a 25% rebate, and owners of other properties (e.g. commercial, industrial, railways, pipelines and designated recreational) will receive a 10% rebate.

There is no application necessary by property owners. The provincial government will automatically calculate the appropriate amount, issue a cheque, and mail the cheque directly to the registered owner of the property. Property owners can expect to receive their EPTR cheques within the same month, or even earlier, that municipal property taxes are due.

Even if a property owner does not currently pay education property tax on their property assessment because of existing tax credits, the Education Property Tax Rebate will still be issued and they will continue to receive benefits that will fully offset school taxes. The only instance wherein the rebate will not be paid, is when the amount owing would be less than $2.00.

The rebate is calculated based on annual education property taxes, and is calculated before any tax credits (such as the Education Property Tax Credit) are applied. Below is an example of how the debate will be applied.

For instances where there are two property owners on title, there will only be one cheque issued by the province. However, the owner who did not receive the rebate is legally entitled to their portion of the rebate from the receiving owner. For each subsequent year following 2021 (until educational property taxes are eliminated completely), the EPTR rates can be raised but not lowered. The government has indicated that for 2022 annual property taxes, the rebate will rise from 25% to 50% for residential and farm properties and from 10% to 20% for owners of other properties (e.g. commercial, industrial, railways, pipelines and designated recreational). These increases can subject to a further increase if it is prescribed by the Lieutenant Governor in Council.

Notice: The articles on our website are provided for general information purposes only and should not be relied upon as legal advice or opinion. They reflect the current state of the law as at the date of posting on the website, and are subject to change without notice. If you require legal advice or opinion, we would be pleased to provide you with our assistance on any of the issues raised in these articles.