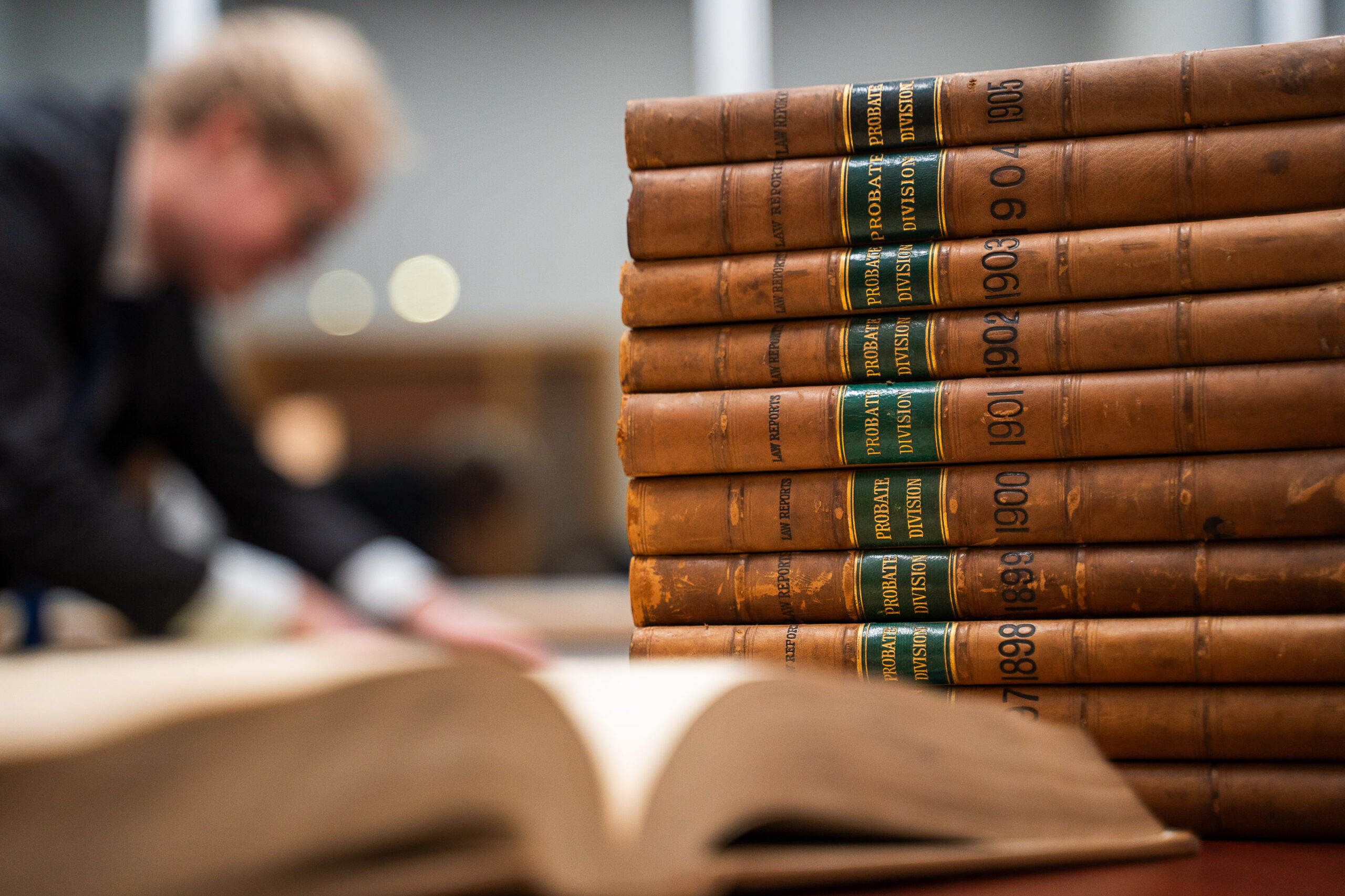

Smith Neufeld Jodoin LLP has its head office in Steinbach and has been representing clients in Southern Manitoba since 1973. Smith Neufeld Jodoin prides itself on ensuring your legal needs are met quickly and comprehensively.

Our team of lawyers practise in various areas of law and also provide services in English, French, High German and Low German. Our Mission Statement reflects our commitment to providing the very best in legal services to you. Smith Neufeld Jodoin has its main office in Steinbach with a full-time branch office in Niverville and a part-time branch office in Grunthal.

Our goal is to provide legal services in a comprehensive, efficient and courteous manner. We endeavour to understand the needs of our clients and to help our clients achieve their goals.